Navigating the 2025 Holiday Season with Intuit Payroll: A Comprehensive Guide

Related Articles: Navigating the 2025 Holiday Season with Intuit Payroll: A Comprehensive Guide

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the 2025 Holiday Season with Intuit Payroll: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the 2025 Holiday Season with Intuit Payroll: A Comprehensive Guide

The holiday season is a time for celebration, but for businesses, it also presents a unique set of challenges. Managing payroll during this period requires careful planning and attention to detail, especially when considering the various holidays and observances that occur throughout the year. Intuit Payroll, a leading provider of payroll solutions, offers a comprehensive holiday calendar that simplifies this process for businesses of all sizes.

Understanding the Intuit Payroll Holiday Calendar

The Intuit Payroll holiday calendar is a valuable resource that provides a detailed overview of federal, state, and local holidays observed in the United States throughout 2025. This calendar serves as a critical tool for businesses to:

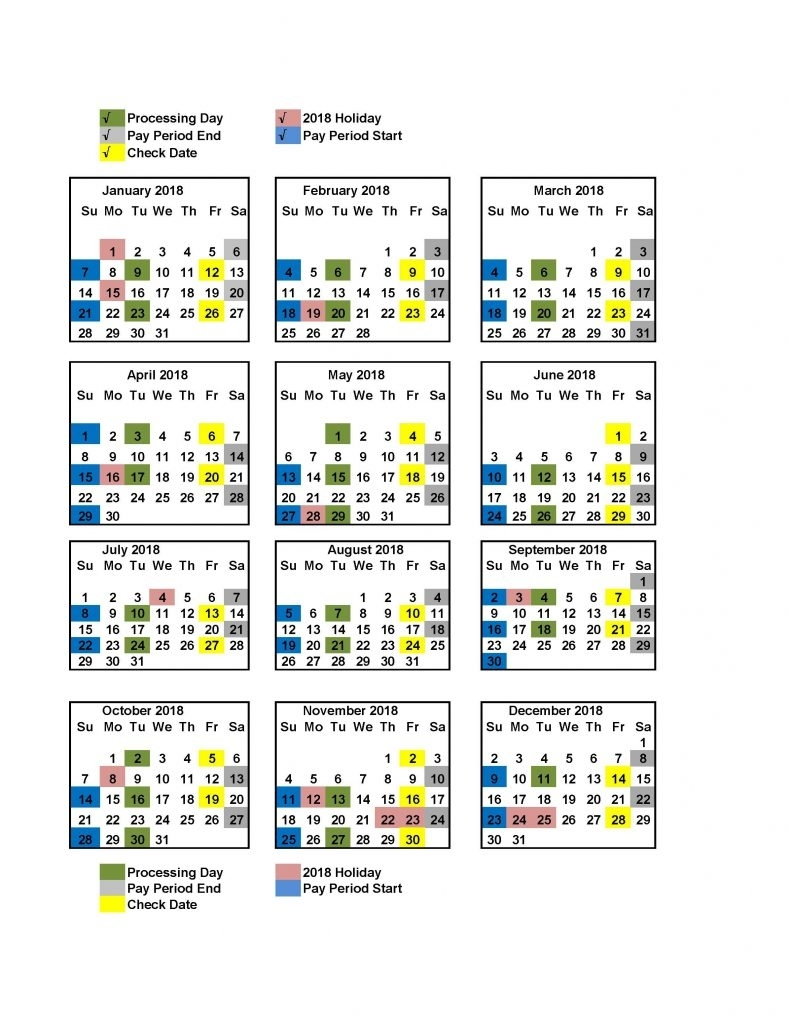

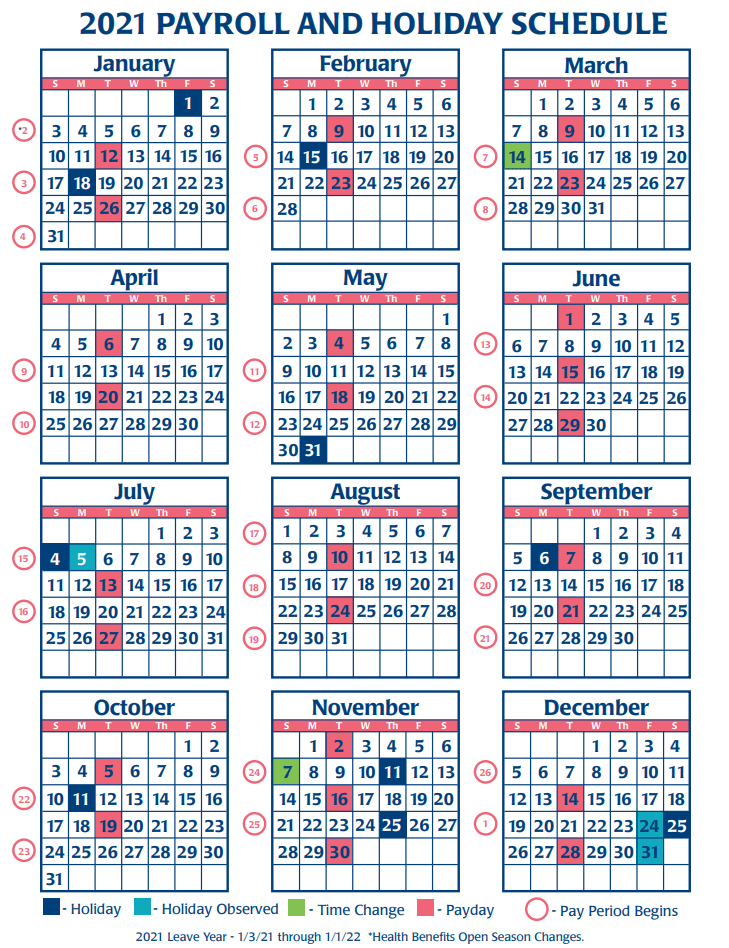

- Plan Payroll Processing: By identifying holidays in advance, businesses can schedule payroll processing efficiently, ensuring timely payments to employees.

- Avoid Payroll Errors: The calendar helps businesses avoid errors related to holiday pay, overtime calculations, and other payroll-related complexities.

- Ensure Compliance: The Intuit Payroll holiday calendar ensures businesses comply with all relevant labor laws and regulations regarding holiday pay and time off.

- Optimize Business Operations: Understanding holiday schedules allows businesses to adjust their operational plans, staffing levels, and customer service strategies to accommodate potential changes in workforce availability.

Benefits of Using the Intuit Payroll Holiday Calendar

The Intuit Payroll holiday calendar offers numerous benefits for businesses, including:

- Accuracy and Reliability: The calendar is meticulously curated and updated to reflect the latest holiday information, ensuring accuracy and reliability.

- User-Friendliness: The calendar is designed for ease of use, with a clear and intuitive interface that makes it simple to navigate and find relevant information.

- Time-Saving: The calendar eliminates the need for businesses to manually research and track holiday dates, saving valuable time and effort.

- Cost-Effectiveness: By reducing payroll errors and ensuring compliance, the calendar helps businesses avoid potential financial penalties and legal issues.

Key Features of the Intuit Payroll Holiday Calendar

The Intuit Payroll holiday calendar offers a range of features designed to simplify holiday management for businesses:

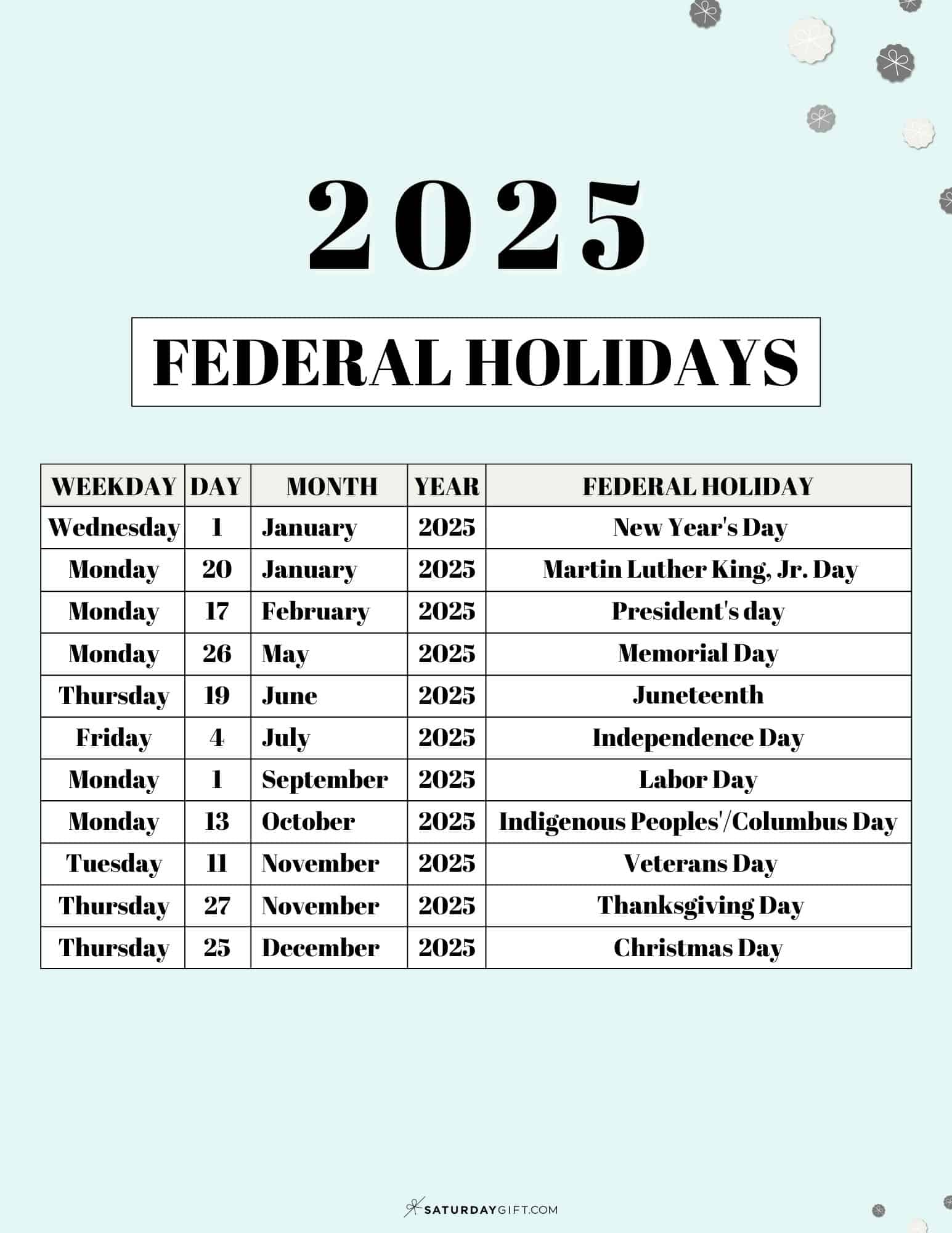

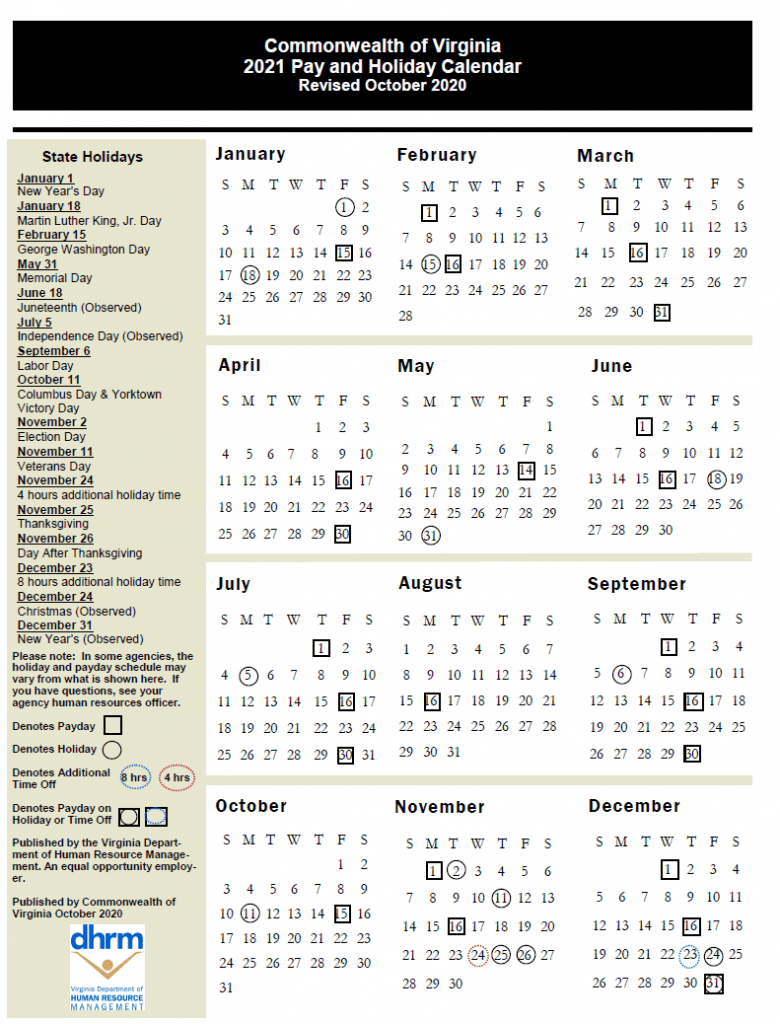

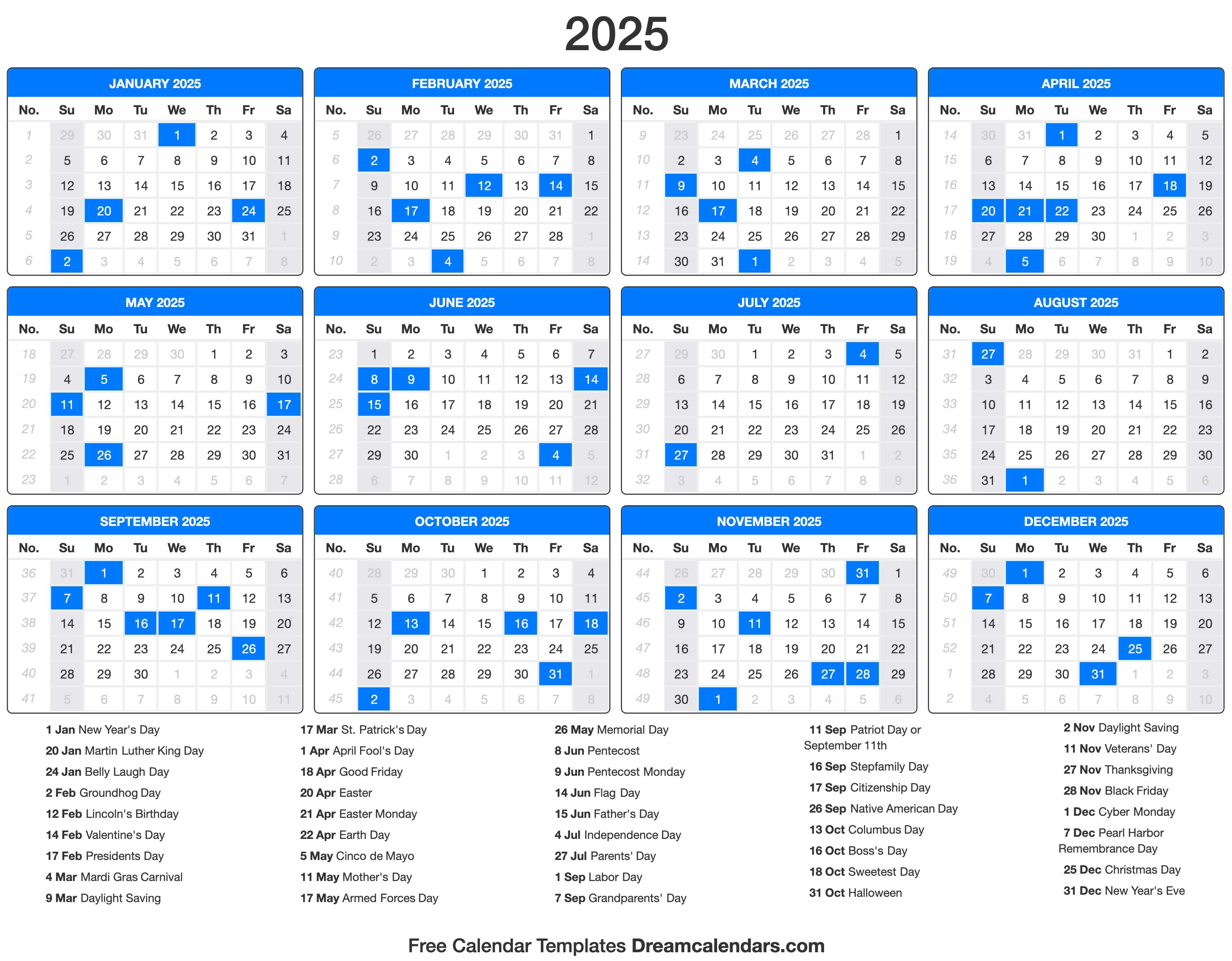

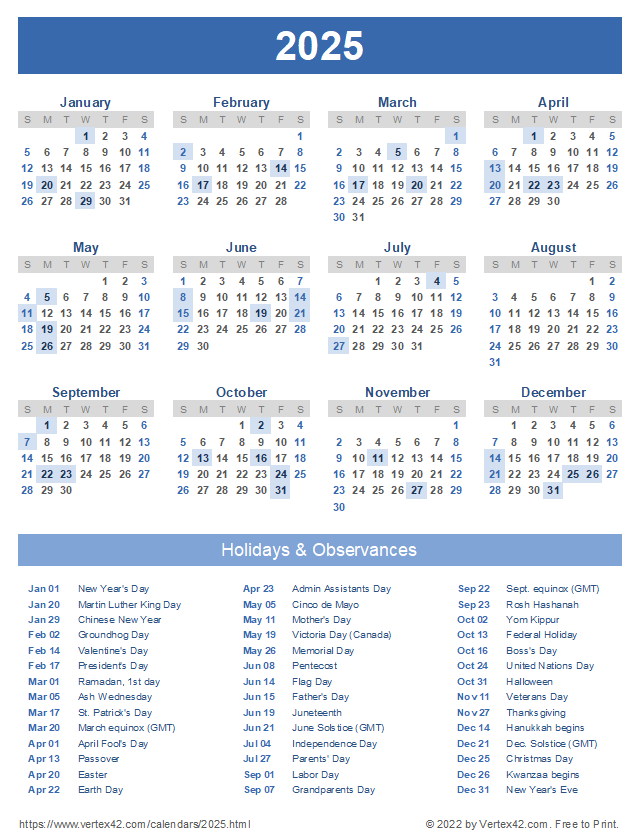

- Detailed Holiday Information: The calendar provides comprehensive information about each holiday, including its date, name, and legal status.

- State-Specific Holidays: The calendar includes both federal and state holidays, allowing businesses to identify holidays specific to their location.

- Local Observances: The calendar also incorporates local observances, such as school holidays or religious holidays, providing a complete picture of potential workforce disruptions.

- Customizable Options: Users can customize the calendar to display only the holidays relevant to their business needs, filtering out irrelevant information.

- Downloadable Format: The calendar can be downloaded in various formats, including PDF, CSV, and Excel, allowing businesses to integrate it into their existing systems.

FAQs About the Intuit Payroll Holiday Calendar

Q: What holidays are included in the Intuit Payroll holiday calendar?

A: The calendar includes all federal holidays, state holidays, and local observances recognized in the United States.

Q: Is the calendar updated regularly?

A: Yes, the calendar is updated regularly to reflect any changes in holiday dates or observances.

Q: How can I access the Intuit Payroll holiday calendar?

A: The calendar is available on the Intuit Payroll website and within the Intuit Payroll software.

Q: What if my business operates in multiple states?

A: The calendar allows you to filter by state, so you can view holidays specific to each location where your business operates.

Q: Can I customize the calendar to exclude certain holidays?

A: Yes, you can customize the calendar to display only the holidays relevant to your business.

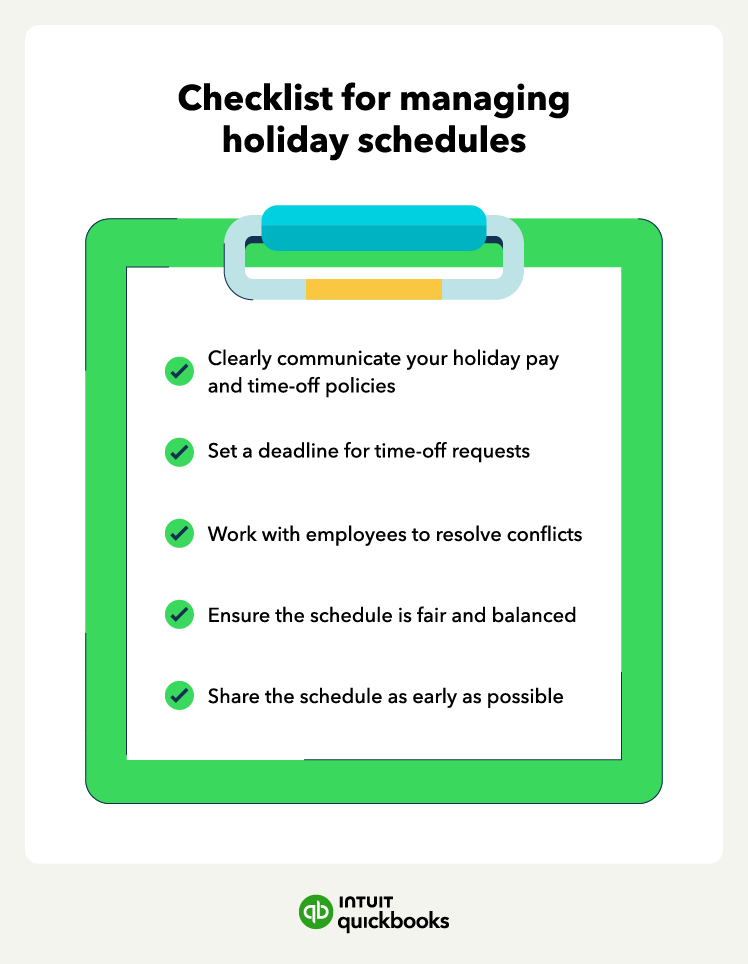

Tips for Using the Intuit Payroll Holiday Calendar

- Plan Ahead: Review the calendar well in advance of the holiday season to plan for potential staffing shortages or operational adjustments.

- Communicate with Employees: Inform employees about holiday schedules and any associated pay or time-off policies.

- Review Payroll Procedures: Ensure your payroll procedures are up-to-date and compliant with holiday regulations.

- Utilize the Calendar’s Features: Take advantage of the calendar’s customization options and downloadable formats to streamline your holiday management process.

- Seek Professional Guidance: If you have any questions or concerns about holiday pay or other payroll-related matters, consult with a payroll professional.

Conclusion

The Intuit Payroll holiday calendar is an invaluable tool for businesses looking to simplify holiday management and ensure accurate and timely payroll processing. By providing comprehensive holiday information, the calendar helps businesses avoid payroll errors, ensure compliance, and optimize their operations during the busy holiday season. By leveraging the calendar’s features and following the tips outlined above, businesses can navigate the complexities of holiday pay and time off with confidence and efficiency.

Closure

Thus, we hope this article has provided valuable insights into Navigating the 2025 Holiday Season with Intuit Payroll: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!