Navigating the 2025 Payroll Landscape: A Comprehensive Guide to Bi-Monthly Payment Schedules

Related Articles: Navigating the 2025 Payroll Landscape: A Comprehensive Guide to Bi-Monthly Payment Schedules

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the 2025 Payroll Landscape: A Comprehensive Guide to Bi-Monthly Payment Schedules. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Navigating the 2025 Payroll Landscape: A Comprehensive Guide to Bi-Monthly Payment Schedules

- 2 Introduction

- 3 Navigating the 2025 Payroll Landscape: A Comprehensive Guide to Bi-Monthly Payment Schedules

- 3.1 Understanding Bi-Monthly Payroll: A Foundation for Success

- 3.2 Navigating the 2025 Bi-Monthly Payroll Calendar: Key Considerations

- 3.3 Bi-Monthly Payroll Calendar 2025: A Practical Guide

- 3.4 FAQs Regarding Bi-Monthly Payroll in 2025

- 3.5 Tips for Effective Bi-Monthly Payroll Management in 2025

- 3.6 Conclusion: Embracing Bi-Monthly Payroll for a Streamlined Future

- 4 Closure

Navigating the 2025 Payroll Landscape: A Comprehensive Guide to Bi-Monthly Payment Schedules

The year 2025 is rapidly approaching, and with it comes the need for businesses to ensure their payroll systems are optimized for efficiency and compliance. A crucial aspect of this preparation involves understanding and effectively utilizing bi-monthly payroll calendars. This comprehensive guide will delve into the intricacies of bi-monthly payment schedules, exploring their benefits, potential challenges, and essential considerations for seamless payroll processing in 2025.

Understanding Bi-Monthly Payroll: A Foundation for Success

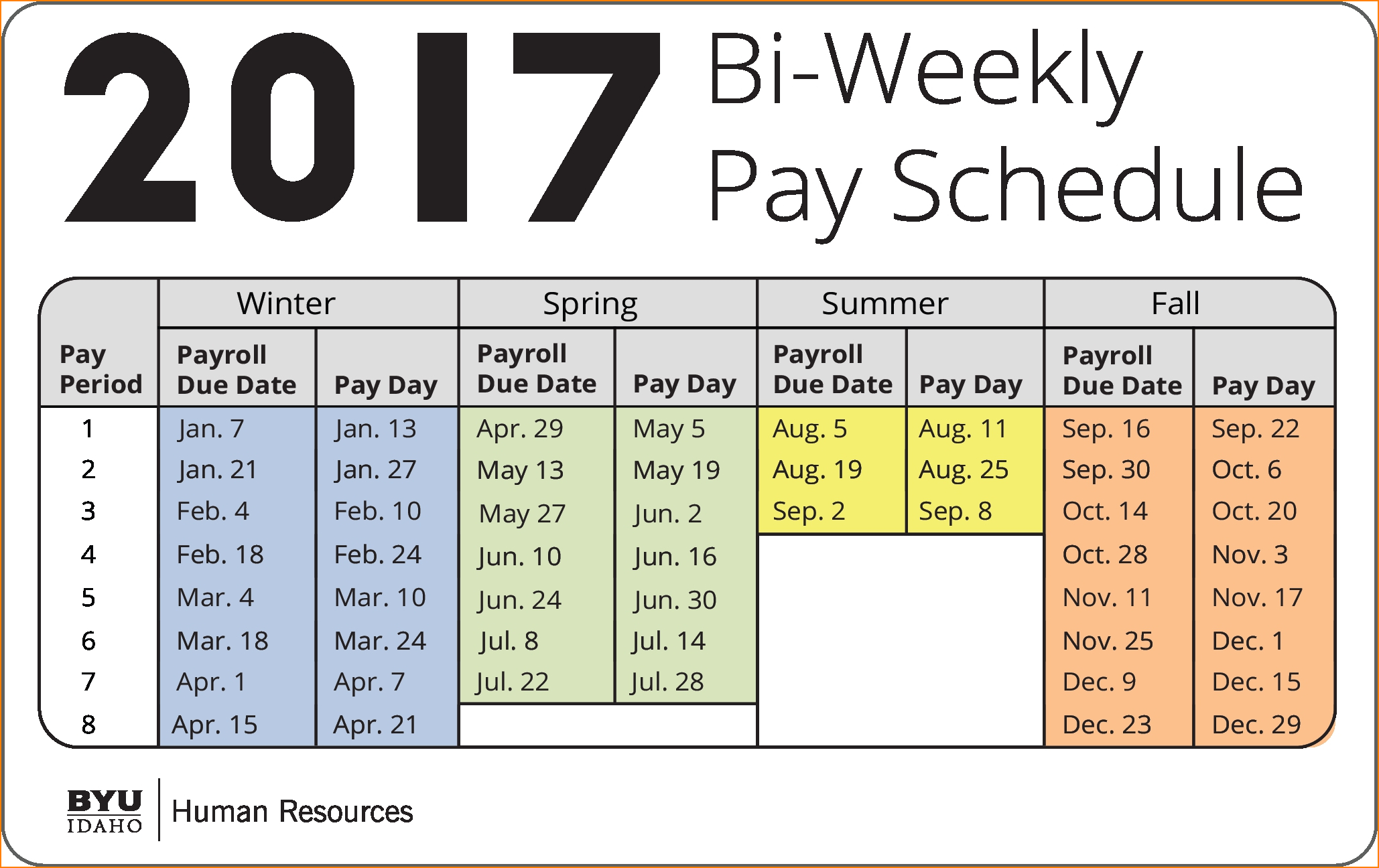

Bi-monthly payroll, as the name suggests, involves paying employees twice a month, typically on the 15th and the last day of the month. This system stands in contrast to other common payment frequencies, such as weekly, semi-monthly, or monthly payroll. While the choice of payment frequency ultimately rests on an organization’s specific needs and preferences, bi-monthly payroll offers several advantages that can streamline operations and enhance employee satisfaction.

Benefits of Bi-Monthly Payroll:

- Predictability and Financial Stability: Employees receive a consistent income stream, facilitating budgeting and financial planning. This predictability fosters a sense of security and reduces financial stress, ultimately contributing to a more stable and engaged workforce.

- Improved Cash Flow Management: Businesses benefit from a more predictable cash flow, as they are required to make payroll payments less frequently compared to weekly or semi-monthly schedules. This can lead to improved financial planning and potentially reduced short-term borrowing needs.

- Simplified Payroll Processing: Bi-monthly payroll often simplifies the payroll process by reducing the number of payroll runs required. This can lead to fewer administrative tasks, reduced potential for errors, and overall increased efficiency.

- Enhanced Compliance: Bi-monthly payroll can simplify compliance with tax regulations, as it aligns with the common tax filing deadlines for many jurisdictions. This reduces the risk of penalties and ensures that payroll taxes are handled accurately and timely.

Navigating the 2025 Bi-Monthly Payroll Calendar: Key Considerations

While bi-monthly payroll offers numerous advantages, it is crucial to carefully consider its implications and ensure a smooth implementation. The following factors should be carefully assessed:

- Payroll System Integration: The chosen payroll system must be capable of handling bi-monthly payment schedules accurately and efficiently. This includes features like automatic payroll calculations, tax withholding, and reporting functionalities.

- Employee Communication: Transparent communication with employees is paramount. Ensure that employees are informed about the transition to bi-monthly payroll, including the new payment dates and any potential changes to their paychecks.

- Tax Implications: Thoroughly understand the tax implications of bi-monthly payroll in your jurisdiction. Consult with a tax professional to ensure compliance with all relevant regulations.

- Timekeeping and Attendance: Implement robust timekeeping and attendance systems to accurately track employee hours and ensure proper payroll calculations. This is particularly crucial for employees who work variable hours or are subject to overtime.

- Employee Benefits: Ensure that employee benefits, such as health insurance and retirement contributions, are seamlessly integrated with the bi-monthly payroll cycle.

Bi-Monthly Payroll Calendar 2025: A Practical Guide

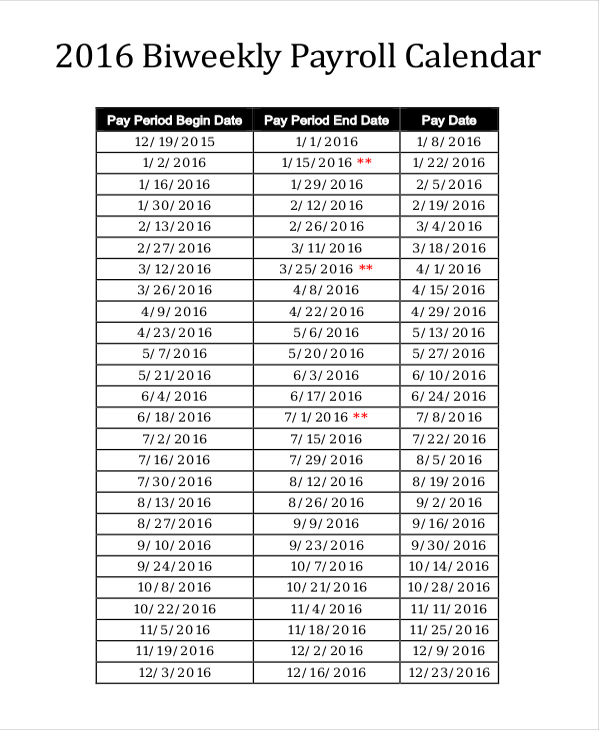

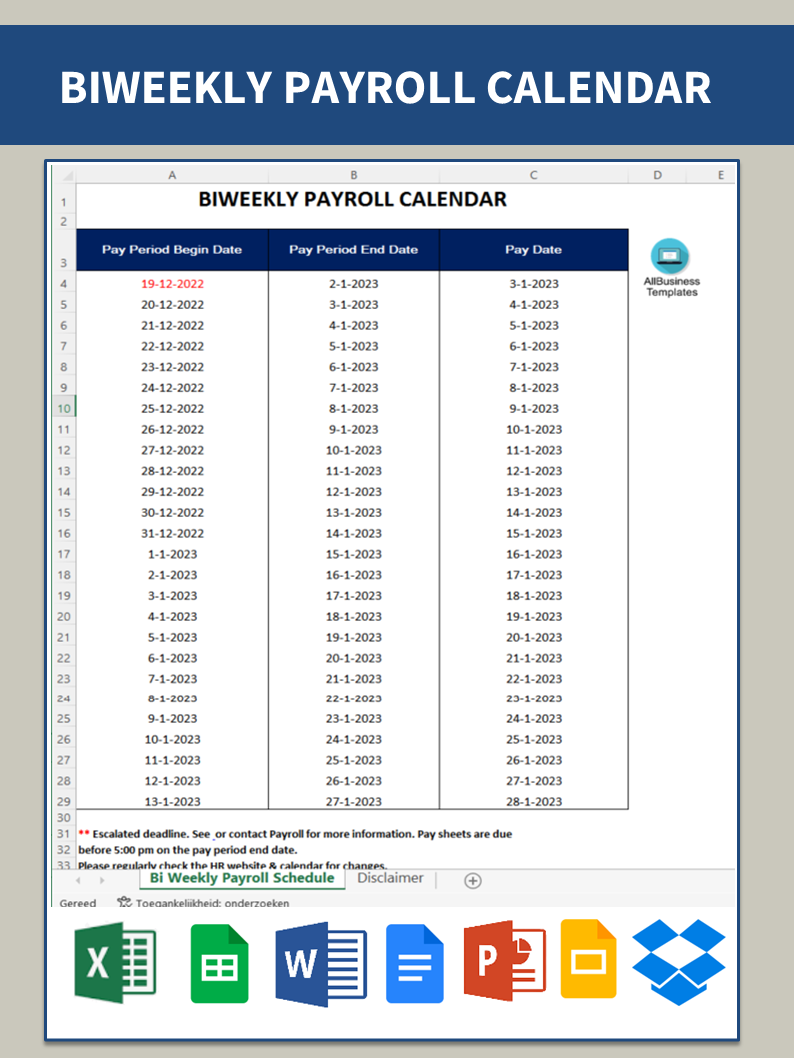

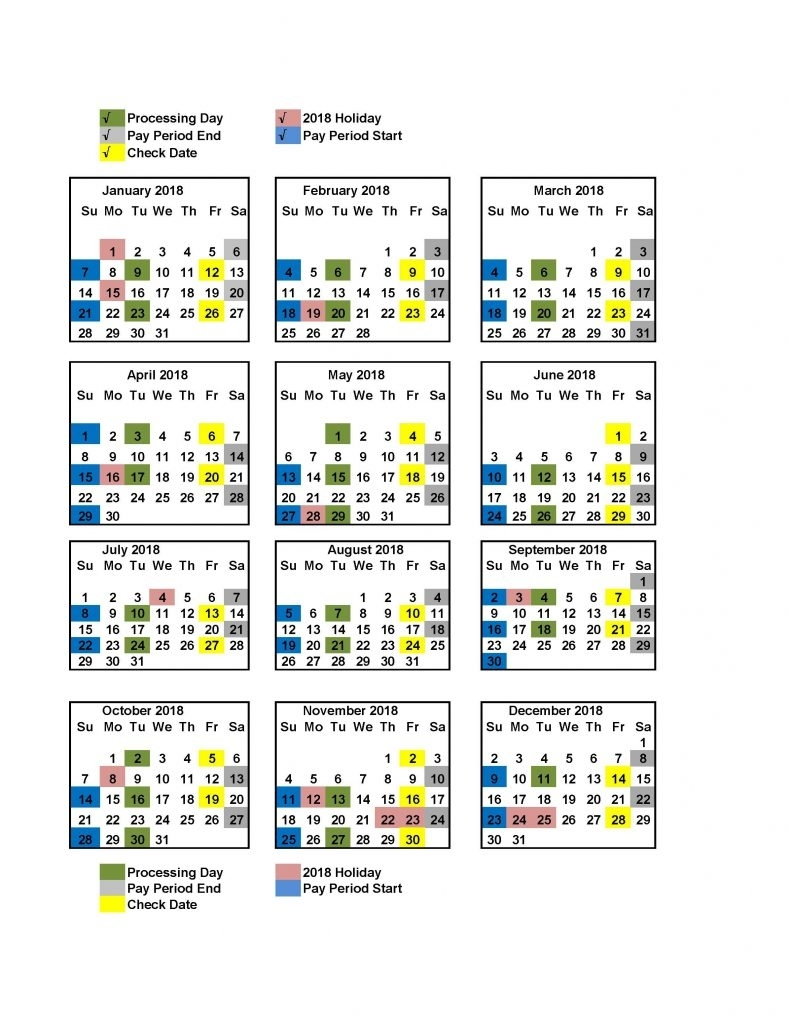

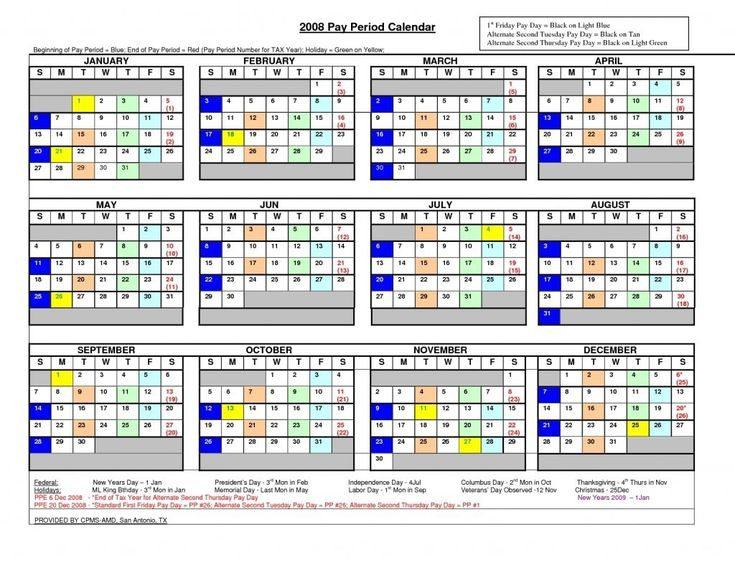

The following table provides a comprehensive bi-monthly payroll calendar for 2025, highlighting the potential payment dates for each month:

| Month | First Payment Date | Second Payment Date |

|---|---|---|

| January | 15th | 31st |

| February | 15th | 28th |

| March | 15th | 31st |

| April | 15th | 30th |

| May | 15th | 31st |

| June | 15th | 30th |

| July | 15th | 31st |

| August | 15th | 31st |

| September | 15th | 30th |

| October | 15th | 31st |

| November | 15th | 30th |

| December | 15th | 31st |

Note: This calendar serves as a general guide. Actual payment dates may vary based on specific company policies, bank holidays, and other factors.

FAQs Regarding Bi-Monthly Payroll in 2025

Q: What are the potential challenges of implementing bi-monthly payroll?

A: Potential challenges include:

- Employee Resistance: Some employees may resist the change in payment frequency, particularly if they are accustomed to a different schedule.

- System Compatibility: Ensuring that the current payroll system is compatible with bi-monthly processing can be challenging.

- Communication and Training: Effectively communicating the change to employees and providing adequate training on the new system is crucial for a smooth transition.

Q: What are the key factors to consider when choosing between bi-monthly and other payment frequencies?

A: Key factors include:

- Industry Standards: The prevailing practices in your industry can influence the choice of payment frequency.

- Employee Preferences: Consider employee preferences and their financial needs.

- Payroll Processing Costs: Different payment frequencies can have varying costs associated with payroll processing.

- Company Cash Flow: Evaluate the impact on your company’s cash flow and financial stability.

Q: How can I ensure a seamless transition to bi-monthly payroll?

A: A seamless transition requires:

- Thorough Planning: Carefully plan the implementation process, considering all aspects of the change.

- Employee Engagement: Communicate transparently with employees and address their concerns.

- System Testing: Thoroughly test the payroll system to ensure accuracy and functionality.

- Training and Support: Provide adequate training to employees and offer ongoing support during the transition.

Q: What are the potential benefits of bi-monthly payroll for employees?

A: Potential benefits for employees include:

- Financial Stability: Predictable income stream for budgeting and financial planning.

- Reduced Stress: Less financial anxiety and a sense of security.

- Improved Savings: Easier to save money with consistent income.

Tips for Effective Bi-Monthly Payroll Management in 2025

- Automate Payroll Processes: Leverage automation tools to streamline payroll tasks and reduce manual errors.

- Implement Strong Internal Controls: Establish robust internal controls to prevent fraud and ensure payroll accuracy.

- Regularly Review Payroll Data: Conduct regular reviews of payroll data to identify and address any discrepancies or potential issues.

- Stay Updated on Regulations: Stay informed about changes in tax laws and labor regulations to ensure compliance.

- Seek Professional Advice: Consult with payroll experts and tax professionals for guidance and support.

Conclusion: Embracing Bi-Monthly Payroll for a Streamlined Future

Bi-monthly payroll, when implemented effectively, can be a valuable tool for businesses in 2025. It offers numerous benefits, including increased financial stability, improved cash flow management, simplified payroll processing, and enhanced compliance. By carefully considering the factors outlined in this guide and taking proactive steps to ensure a smooth transition, organizations can leverage the advantages of bi-monthly payroll and create a more efficient and secure payroll environment for both employees and the business.

Closure

Thus, we hope this article has provided valuable insights into Navigating the 2025 Payroll Landscape: A Comprehensive Guide to Bi-Monthly Payment Schedules. We thank you for taking the time to read this article. See you in our next article!