Navigating the Financial Landscape: A Guide to Understanding Earnings Per Share (EPS) Calendar 2025

Related Articles: Navigating the Financial Landscape: A Guide to Understanding Earnings Per Share (EPS) Calendar 2025

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Financial Landscape: A Guide to Understanding Earnings Per Share (EPS) Calendar 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Navigating the Financial Landscape: A Guide to Understanding Earnings Per Share (EPS) Calendar 2025

- 2 Introduction

- 3 Navigating the Financial Landscape: A Guide to Understanding Earnings Per Share (EPS) Calendar 2025

- 3.1 Unveiling the Significance of the EPS Calendar

- 3.2 Decoding the EPS Calendar: Key Components and Interpretation

- 3.3 Leveraging the EPS Calendar for Informed Investment Decisions

- 3.4 FAQs: Addressing Common Queries About the EPS Calendar

- 3.5 Tips for Effective Utilization of the EPS Calendar

- 3.6 Conclusion: Navigating the Financial Landscape with Confidence

- 4 Closure

Navigating the Financial Landscape: A Guide to Understanding Earnings Per Share (EPS) Calendar 2025

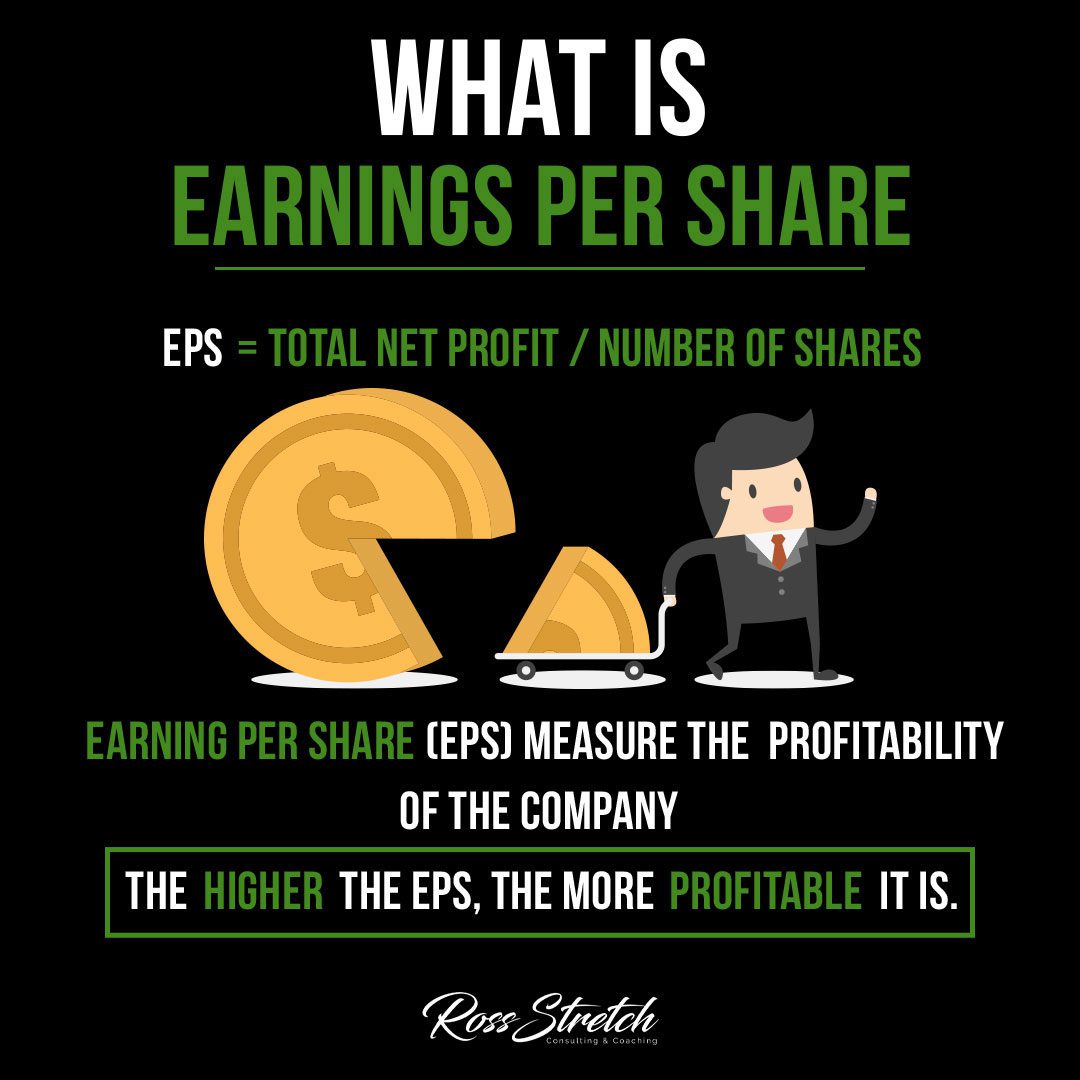

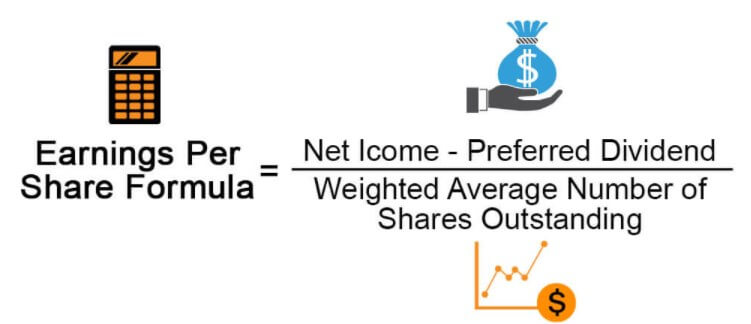

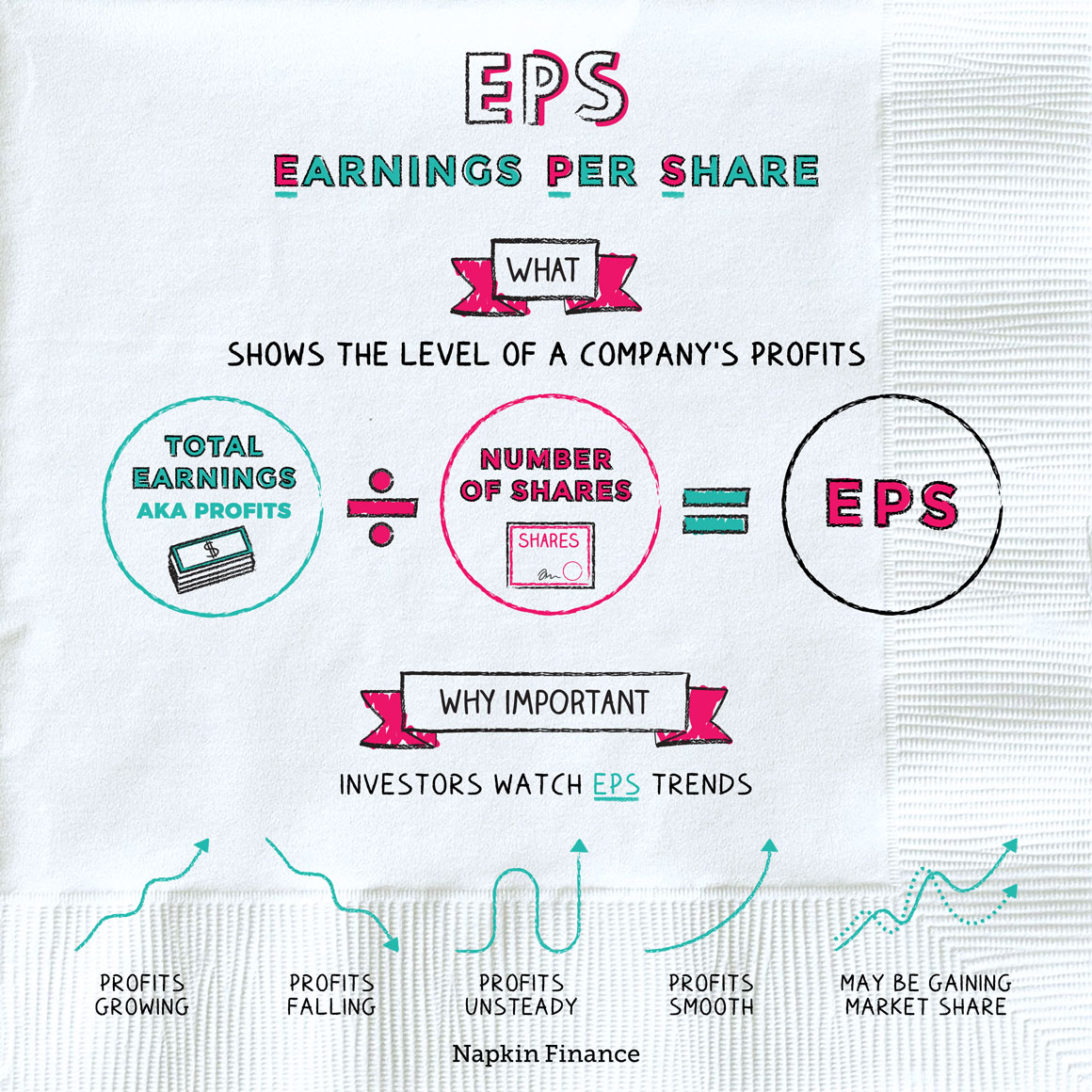

The financial world operates on a complex web of data points and metrics, each offering a unique window into the health and performance of companies. Among these crucial indicators, Earnings Per Share (EPS) stands out as a cornerstone for investors and analysts alike. EPS represents the portion of a company’s profit allocated to each outstanding share of common stock. By tracking the anticipated EPS of publicly traded companies, investors can gain valuable insights into potential investment opportunities and market trends.

The EPS calendar serves as a roadmap for investors, highlighting the dates when companies are expected to release their earnings reports. This calendar is a vital tool for understanding the financial performance of companies and gauging their future prospects. While the specific schedule for 2025 is not yet finalized, understanding the general principles behind the EPS calendar and its uses can empower investors to make informed decisions.

Unveiling the Significance of the EPS Calendar

The EPS calendar holds significant value for various stakeholders in the financial world:

- Investors: Investors use the EPS calendar to identify key earnings release dates and prepare for potential market fluctuations. By anticipating earnings announcements, investors can adjust their portfolios and potentially capitalize on positive or negative market reactions.

- Analysts: Financial analysts rely heavily on the EPS calendar to track company performance and make investment recommendations. They use the information contained in earnings reports to assess a company’s financial health, growth prospects, and overall market position.

- Companies: Companies themselves use the EPS calendar to understand the expectations surrounding their earnings releases. By anticipating investor sentiment and market reactions, companies can better manage their communication strategies and financial reporting processes.

Decoding the EPS Calendar: Key Components and Interpretation

The EPS calendar typically features the following information for each listed company:

- Earnings Release Date: This indicates the date when a company is expected to release its earnings report.

- EPS Estimate: This represents the average estimate of EPS for the period, as predicted by analysts.

- Previous EPS: This provides the EPS figure from the corresponding period in the previous year, offering a baseline for comparison.

- EPS Growth Rate: This metric reflects the percentage change in EPS compared to the previous year, indicating the company’s growth trajectory.

Interpreting the EPS calendar requires careful consideration of various factors:

- Market Context: The overall market sentiment and economic conditions can influence investor reactions to earnings reports. A strong economic outlook, for instance, might lead to more favorable reactions to positive earnings surprises.

- Company-Specific Factors: Each company’s unique industry, competitive landscape, and business model should be factored into the analysis. A company exceeding EPS expectations may not necessarily result in a positive market reaction if the industry is experiencing a downturn.

- Analyst Consensus: The consensus EPS estimate reflects the collective view of analysts, offering valuable insight into market expectations. Significant deviations from the consensus can lead to volatile market reactions.

Leveraging the EPS Calendar for Informed Investment Decisions

The EPS calendar provides a powerful tool for investors seeking to make informed decisions. Here’s how to effectively utilize this resource:

- Prioritize Key Earnings Releases: Identify the companies with the most significant impact on your portfolio and focus on their earnings announcements.

- Analyze Historical Trends: Study past earnings reports to identify patterns and potential growth trends.

- Compare EPS Estimates: Compare the consensus EPS estimate with the company’s previous performance and industry benchmarks.

- Monitor Market Reactions: Pay close attention to market reactions to earnings announcements, as this can indicate investor sentiment and potential future price movements.

- Adjust Portfolio Strategies: Based on the information gleaned from the EPS calendar, adjust your portfolio holdings to capitalize on potential opportunities or mitigate risks.

FAQs: Addressing Common Queries About the EPS Calendar

Q: How is the EPS calendar created?

A: The EPS calendar is typically compiled by financial data providers who collect information from companies, analysts, and regulatory filings. These providers use various sources to forecast earnings release dates and EPS estimates.

Q: Is the EPS calendar always accurate?

A: While providers strive for accuracy, the EPS calendar is subject to change. Companies may adjust their earnings release dates due to unforeseen circumstances, and analyst estimates can vary widely.

Q: What are the limitations of the EPS calendar?

A: The EPS calendar provides a snapshot of expectations and potential market movements. It does not guarantee investment success, and investors should always conduct thorough due diligence before making any investment decisions.

Q: How can I access the EPS calendar?

A: Several financial data providers offer access to EPS calendars, including Bloomberg, Refinitiv, FactSet, and Yahoo Finance. Many online brokerage platforms also provide access to this information.

Tips for Effective Utilization of the EPS Calendar

- Stay Updated: Regularly monitor the EPS calendar for any changes or updates.

- Cross-Reference Information: Compare information from different sources to ensure accuracy.

- Consider Company-Specific Factors: Each company’s unique circumstances should be considered when interpreting the EPS calendar.

- Don’t Rely Solely on the Calendar: The EPS calendar is a valuable tool but should not be the sole basis for investment decisions.

Conclusion: Navigating the Financial Landscape with Confidence

The EPS calendar serves as a vital resource for navigating the complex world of finance. By understanding the principles behind its creation and effectively utilizing its data, investors can gain valuable insights into company performance, market trends, and potential investment opportunities. While the calendar itself does not provide guaranteed investment success, it empowers investors to make informed decisions and navigate the financial landscape with confidence.

:max_bytes(150000):strip_icc()/EPS-final-838bf0756ca04435ae9e15237ca914a7.png)

Closure

Thus, we hope this article has provided valuable insights into Navigating the Financial Landscape: A Guide to Understanding Earnings Per Share (EPS) Calendar 2025. We thank you for taking the time to read this article. See you in our next article!