Navigating the Tax Landscape: Understanding the 2025 Tax Year Calendar

Related Articles: Navigating the Tax Landscape: Understanding the 2025 Tax Year Calendar

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Tax Landscape: Understanding the 2025 Tax Year Calendar. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Tax Landscape: Understanding the 2025 Tax Year Calendar

The tax year 2025 calendar is a critical roadmap for individuals and businesses alike, outlining key deadlines and providing a framework for managing financial obligations. Understanding this calendar is essential for ensuring timely compliance, maximizing deductions, and avoiding potential penalties.

The Fundamentals of the Tax Year Calendar

The tax year in the United States runs from January 1st to December 31st. This means that all income earned and expenses incurred during this period are reported on your tax return for the following year. For example, income earned in 2025 will be reported on your 2025 tax return, which is filed in 2026.

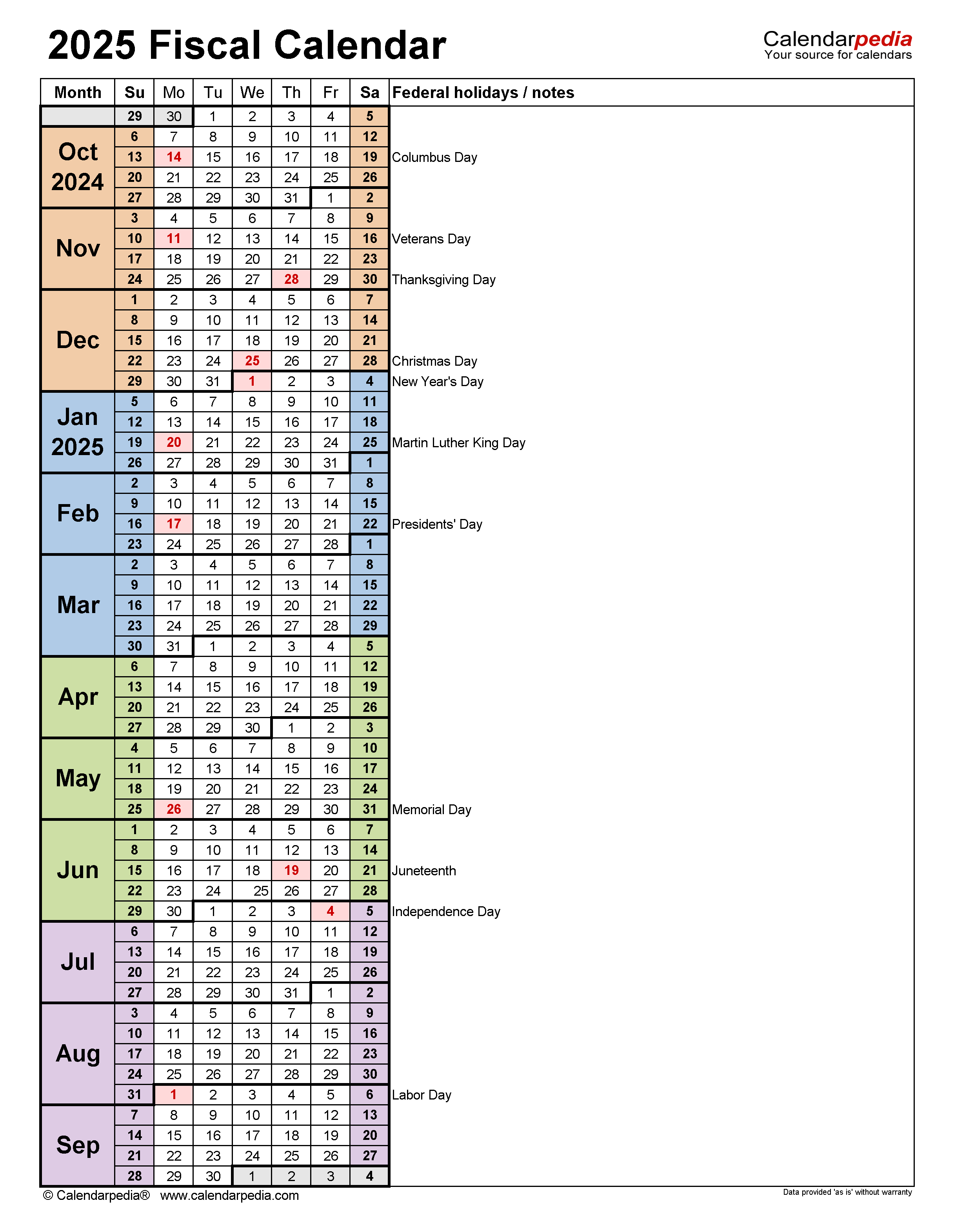

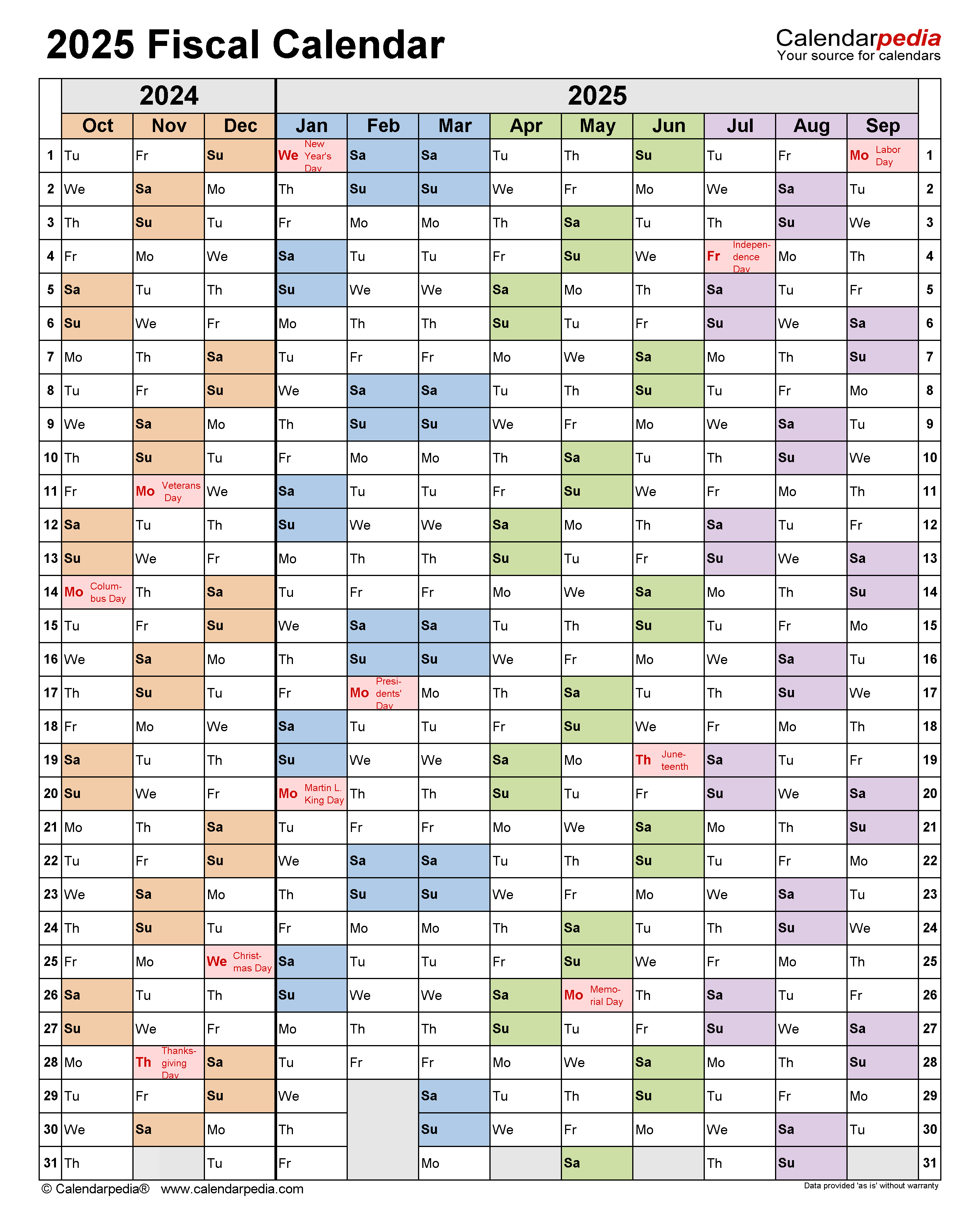

The 2025 tax year calendar is marked by several key dates that dictate when certain actions must be taken. These include:

-

Tax Filing Deadline: This is the date by which all tax returns must be filed with the Internal Revenue Service (IRS). The standard filing deadline is typically April 15th of the following year. However, this date can shift if April 15th falls on a weekend or holiday.

-

Estimated Tax Payments: Individuals and businesses with self-employment income or other income not subject to withholding may be required to make quarterly estimated tax payments. These payments are due on specific dates throughout the year.

-

Tax Extension Deadline: If you are unable to file your tax return by the standard deadline, you can request an extension. This allows you an additional six months to file your return, but it does not extend the time to pay any taxes owed.

Understanding the Importance of the Tax Year Calendar

The 2025 tax year calendar is more than just a list of deadlines. It serves as a guide to help individuals and businesses navigate the complex world of taxes. By understanding the key dates and requirements, taxpayers can:

-

Avoid Penalties: Timely filing and payment are crucial to avoid penalties. The IRS imposes penalties for late filing, late payment, and underpayment.

-

Maximize Deductions and Credits: The calendar provides a framework for identifying potential deductions and credits throughout the year. This can significantly reduce your tax liability.

-

Plan for Future Tax Obligations: By understanding the tax year calendar, individuals and businesses can plan for future tax obligations, ensuring they have adequate funds available.

Navigating the 2025 Tax Year Calendar: A Step-by-Step Guide

-

Gather Your Tax Information: Throughout the year, carefully track all income received, expenses incurred, and any other relevant financial information. This includes:

- W-2 Forms: These forms report your wages and withholdings from your employer.

- 1099 Forms: These forms report income from sources other than employment, such as freelance work or investments.

- Receipts and Documentation: Keep detailed records of all expenses, including medical expenses, charitable donations, and business expenses.

-

Calculate Your Estimated Tax Payments: If you are required to make estimated tax payments, use the IRS’s guidelines to calculate your estimated liability. This information is typically available on the IRS website.

-

Monitor Your Tax Situation: Throughout the year, review your income and expenses to ensure you are on track with your tax obligations. Make adjustments to your estimated payments if needed.

-

File Your Tax Return: When the filing season arrives, use your gathered information to file your tax return accurately and on time. Utilize tax software or a qualified tax professional to help you navigate the process.

Frequently Asked Questions (FAQs) About the 2025 Tax Year Calendar

Q: When is the tax filing deadline for the 2025 tax year?

A: The standard filing deadline for the 2025 tax year is April 15, 2026. However, this date may be adjusted if April 15th falls on a weekend or holiday.

Q: Who is required to make estimated tax payments?

A: Individuals and businesses with self-employment income or other income not subject to withholding may be required to make estimated tax payments. This includes:

- Individuals who expect to owe taxes but are not subject to withholding.

- Individuals who have significant income from sources other than employment, such as investments or rental properties.

- Self-employed individuals.

Q: How often are estimated tax payments due?

A: Estimated tax payments are typically due quarterly on the following dates:

- April 15th

- June 15th

- September 15th

- January 15th of the following year

Q: What happens if I don’t file my tax return by the deadline?

A: The IRS imposes penalties for late filing. The penalty is typically calculated as a percentage of the unpaid tax liability.

Q: What happens if I don’t pay my taxes by the deadline?

A: The IRS imposes penalties for late payment. The penalty is typically calculated as a percentage of the unpaid tax liability.

Q: Can I get an extension to file my tax return?

A: Yes, you can request an extension to file your tax return. This will give you an additional six months to file your return, but it does not extend the time to pay any taxes owed.

Q: What are some common deductions and credits available to taxpayers?

A: Common deductions and credits include:

- Standard deduction: This is a fixed amount that you can deduct from your taxable income.

- Itemized deductions: These are deductions that you can claim for specific expenses, such as medical expenses, charitable donations, and home mortgage interest.

- Child tax credit: This credit is available to taxpayers with qualifying children.

- Earned income tax credit: This credit is available to low- and moderate-income working individuals and families.

Tips for Success in the 2025 Tax Year

-

Organize Your Financial Records: Keep detailed records of all income and expenses throughout the year. This will make filing your tax return much easier.

-

Plan for Tax Obligations: Use the tax year calendar to plan for future tax obligations, ensuring you have adequate funds available.

-

Utilize Tax Software or a Tax Professional: Tax software or a qualified tax professional can help you navigate the complex tax code and ensure you are taking advantage of all available deductions and credits.

-

Stay Informed About Tax Changes: Tax laws can change frequently, so it is important to stay informed about any updates or changes that may affect your tax obligations.

Conclusion

The 2025 tax year calendar is a valuable resource for individuals and businesses seeking to navigate the complex world of taxes. By understanding the key dates and requirements, taxpayers can ensure timely compliance, maximize deductions, and avoid potential penalties. By following the tips outlined above, individuals and businesses can prepare for the 2025 tax year with confidence.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Tax Landscape: Understanding the 2025 Tax Year Calendar. We hope you find this article informative and beneficial. See you in our next article!