The Right to Reconsider: Understanding the Three-Day Rescission Period

Related Articles: The Right to Reconsider: Understanding the Three-Day Rescission Period

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to The Right to Reconsider: Understanding the Three-Day Rescission Period. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Right to Reconsider: Understanding the Three-Day Rescission Period

In the realm of consumer finance, the concept of a "cooling-off period" offers a crucial safeguard for individuals entering into significant financial agreements. This period, often referred to as a three-day rescission period, provides consumers with a window of time to reconsider their decisions and potentially back out of contracts without penalty. This right to rescind, or cancel, is a fundamental aspect of consumer protection legislation, ensuring fairness and transparency in financial transactions.

The Origins and Purpose of the Three-Day Rescission Period

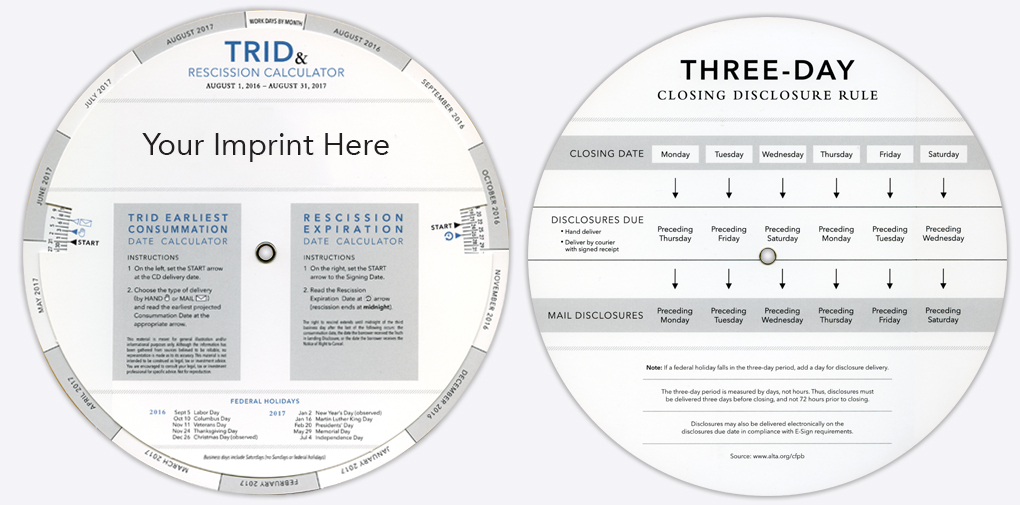

The three-day rescission period finds its roots in the Truth in Lending Act (TILA) of 1968, which aimed to standardize lending practices and protect consumers from predatory lending tactics. This legislation mandates a three-day window for consumers to cancel certain types of credit transactions, including home equity loans, refinancing agreements, and certain types of debt consolidation loans.

The primary purpose of this rescission period is to empower consumers to make informed decisions. High-pressure sales tactics and the complexity of financial documents can sometimes lead to rushed decisions that consumers later regret. The three-day window allows individuals to carefully review the terms of the agreement, seek independent advice, and ultimately decide if the transaction aligns with their financial goals and circumstances.

Understanding the Scope of the Rescission Period

It’s crucial to understand that the three-day rescission period does not apply to all financial transactions. The scope of this right is limited to specific types of credit transactions, including:

- Home Equity Loans: Loans secured by a homeowner’s equity in their property. These loans are typically used for various purposes, such as home improvements, debt consolidation, or medical expenses.

- Refinancing Agreements: Agreements to restructure existing loans, potentially altering interest rates, terms, or loan amounts.

- Debt Consolidation Loans: Loans designed to combine multiple debts into a single loan, often with a lower interest rate or a longer repayment term.

The rescission period does not apply to:

- First Mortgage Loans: Loans used to purchase a primary residence.

- Open-End Credit Transactions: Credit cards and lines of credit that allow for repeated borrowing and repayment.

- Loans Secured by Personal Property: Loans secured by assets such as vehicles or jewelry.

The Rescission Process: How to Exercise Your Right

If you find yourself in a situation where you wish to exercise your right to rescind a credit transaction, the process is relatively straightforward:

- Notify the Lender: You must provide written notification to the lender of your intent to rescind the agreement. This notification can be sent by certified mail, return receipt requested, or delivered in person.

- Provide Clear Intent: The notification should explicitly state your intent to rescind the transaction and include the date the agreement was signed.

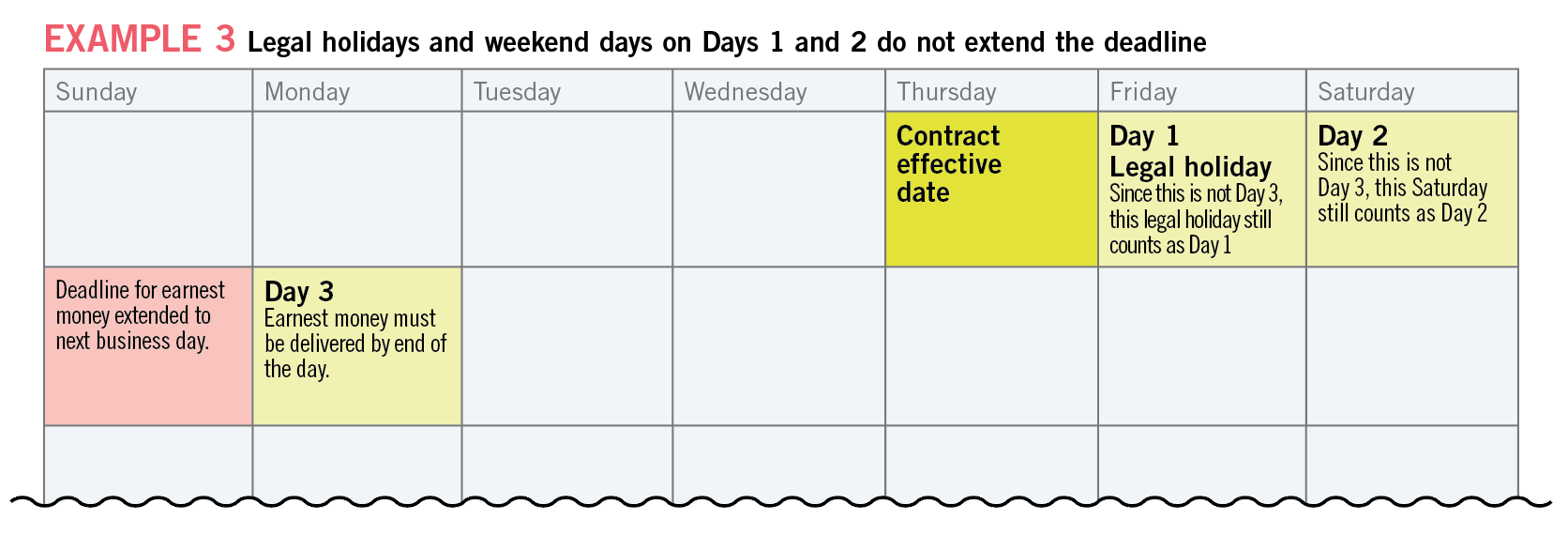

- Deadline: The rescission period begins on the date the agreement is signed or the date the consumer receives the necessary disclosures, whichever is later.

- Return of Funds: The lender is obligated to return any funds received as a result of the transaction, including any interest charges or fees.

Consequences of Failing to Exercise Your Right

While the three-day rescission period provides a valuable safeguard, it’s essential to understand that failing to exercise this right within the allotted time frame can have significant consequences. Once the three-day period has expired, the consumer generally loses the right to rescind the agreement, and the loan becomes legally binding.

Benefits of the Three-Day Rescission Period

The three-day rescission period offers numerous benefits to consumers:

- Protection from Predatory Lending: The rescission period safeguards consumers from high-pressure sales tactics and potentially unfavorable loan terms.

- Time for Informed Decision-Making: The three-day window allows consumers to carefully review the terms of the agreement, consult with financial advisors, and make a well-informed decision.

- Reduced Financial Risk: The right to rescind mitigates financial risk by providing a safety net for consumers who may have entered into a transaction without fully understanding its implications.

- Consumer Empowerment: The rescission period empowers consumers to take control of their financial decisions and ensures that they are not bound by agreements they did not fully understand.

FAQs Regarding the Three-Day Rescission Period

1. What happens if I am unable to return the funds received from the loan?

If you are unable to return the funds received from the loan, the lender may be able to pursue legal action to recover the outstanding amount.

2. Can I rescind a loan if I have already made payments?

Yes, you can still rescind a loan even if you have already made payments. The lender will be required to refund any payments you have made.

3. Can I rescind a loan if I have already used the funds?

Yes, you can still rescind a loan even if you have already used the funds. The lender will be required to refund any payments you have made and any funds you have used.

4. What happens if the lender fails to return the funds within the required timeframe?

If the lender fails to return the funds within the required timeframe, you may be able to file a complaint with the Consumer Financial Protection Bureau (CFPB).

5. Can I rescind a loan if I am dissatisfied with the lender’s services?

No, you cannot rescind a loan simply because you are dissatisfied with the lender’s services. The rescission period is intended to protect consumers from unfavorable loan terms, not from poor customer service.

Tips for Utilizing the Three-Day Rescission Period

- Read the Agreement Carefully: Take the time to read the entire loan agreement thoroughly and understand all of its terms and conditions.

- Ask Questions: Don’t hesitate to ask questions if you don’t understand anything in the agreement.

- Seek Independent Advice: Consult with a financial advisor or attorney to ensure you are making an informed decision.

- Document Everything: Keep a record of all communications with the lender, including any written notifications or requests.

- Act Promptly: Exercise your right to rescind within the three-day period to avoid losing this valuable protection.

Conclusion

The three-day rescission period is a crucial consumer protection tool that empowers individuals to make informed financial decisions. By providing a window of time to reconsider and potentially cancel certain types of credit transactions, this legislation safeguards consumers from predatory lending practices and ensures fairness and transparency in the financial marketplace. Understanding the scope of the rescission period, the process for exercising this right, and the potential consequences of failing to act promptly are essential for maximizing the benefits of this important consumer protection measure.

Closure

Thus, we hope this article has provided valuable insights into The Right to Reconsider: Understanding the Three-Day Rescission Period. We appreciate your attention to our article. See you in our next article!